Roskam, Renacci & Meehan Express Optimism — and a Sense of Urgency — about Reforming the Tax Code in 2017

Roskam, Renacci & Meehan Express Optimism — and a Sense of Urgency — about Reforming the Tax Code in 2017

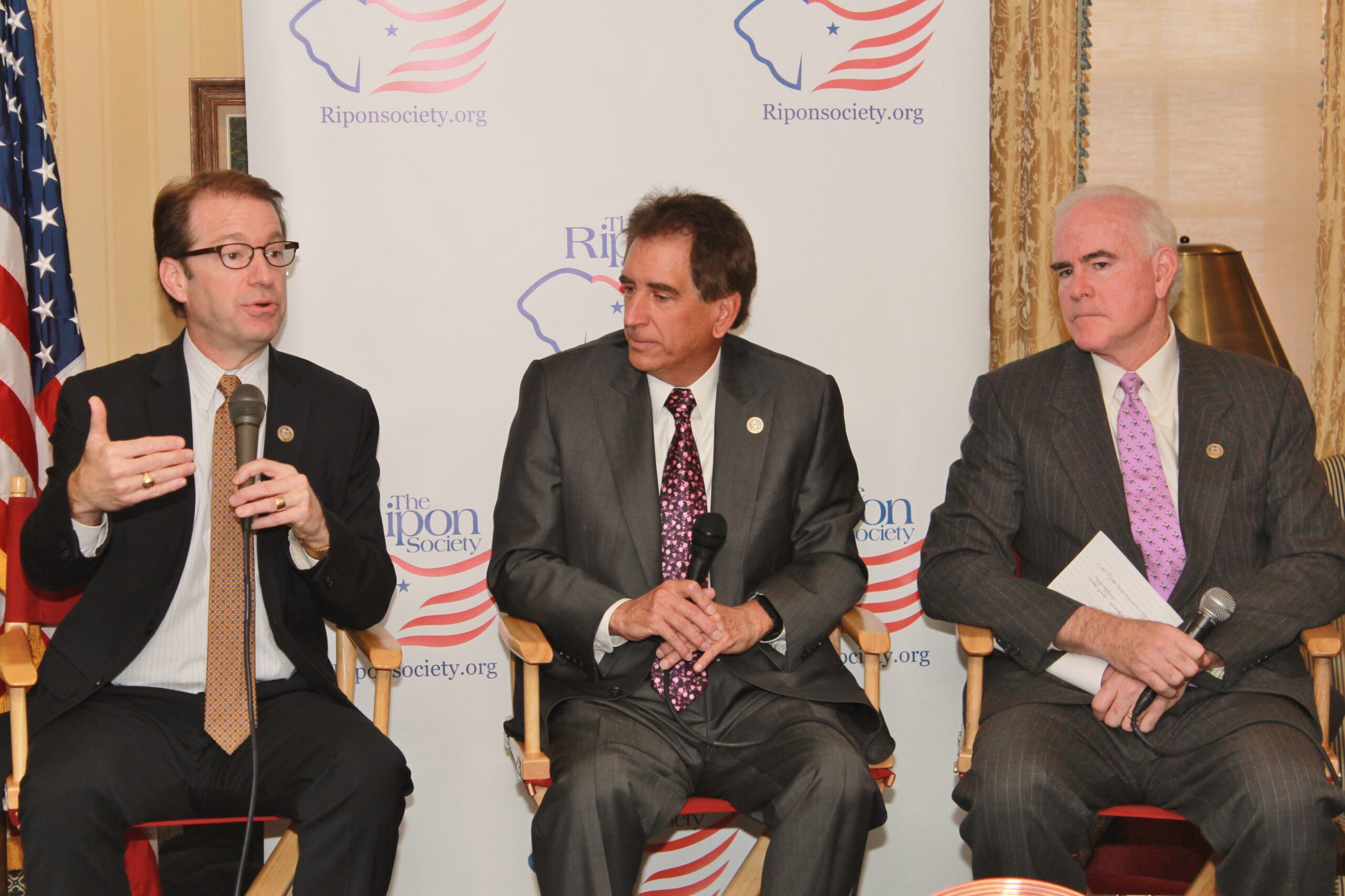

WASHINGTON, DC – With tax reform near the top of the agenda in Washington, The Ripon Society held a breakfast discussion yesterday morning with three Congressmen who serve on the Ways & Means Tax Policy Subcommittee and are at the forefront of the effort to reach agreement on a reform plan this year.

The Congressmen were: Peter Roskam, who represents the 6th District of Illinois about an hour west of Chicago; Jim Renacci, who represents the 16th District of Ohio just south of Cleveland between Akron and Canton; and, Pat Meehan, who represents the 7th District of Pennsylvania just outside Philadelphia. Roskam serves as Chairman of the Tax Policy panel, and kicked off the discussion by framing the magnitude of the debate.

“We’re at a national inflection point as it relates to tax reform,” Roskam stated. “We’ve got a country that looks at 70,000 pages, and they’re completely crushed by it. We’ve got the shine off the penny of the IRS. They had a reputation 20 years ago of being tough but fair. They don’t deserve that reputation today, and they don’t have that reputation today. And then the U.S tax base is eroding. And it’s eroding in a way in which it just is unsettling.”

Roskam, who was first elected to Congress in 2006, took the reins of the Tax Policy Subcommittee this year. He previously served as Chairman of the Oversight Subcommittee – a position that not only gave him a first-hand perspective of the inner-workings of the tax system, but a sense of both urgency and optimism about getting something done this year.

“I am of the opinion that tax reform is more likely than not in 2017,” the Illinois lawmaker said. “I am also of the opinion that if we don’t get this done in 2017, we will never get this done. Subsequent meetings and subsequent PowerPoints are going to be having lists of companies that are going to be, ‘Oh, when did Walgreens leave?’ ‘Oh they left in 2018.’ ‘When did McDonald’s leave?’ ‘They left…’ You get my point. We have a tax code that is pushing business overseas. So here’s the threshold question: What do we do about that?

“I am of the opinion that tax reform is more likely than not in 2017,” the Illinois lawmaker said. “I am also of the opinion that if we don’t get this done in 2017, we will never get this done. Subsequent meetings and subsequent PowerPoints are going to be having lists of companies that are going to be, ‘Oh, when did Walgreens leave?’ ‘Oh they left in 2018.’ ‘When did McDonald’s leave?’ ‘They left…’ You get my point. We have a tax code that is pushing business overseas. So here’s the threshold question: What do we do about that?

“The House has contemplated and is actively wrestling through a blueprint. We’re trying to approach it in a very different way than the Affordable Care Act that was passed. We’re trying to give this a lot of time, and a lot of discussion points, and have a lot of input — and we are. But when it all comes down to it, the question that we all need to ask is: What’s our tolerance for the status quo? My tolerance for the status quo is quite low. So I think we have an opportunity here. As for the blueprint, I told my colleagues and I’ve told any number of other people that if you think everybody’s going to like you at the end of the tax reform process, you’re kidding yourself.”

Renacci concurred.

“I agree with what Peter just said,” the Ohio Republican stated. “We have to change something. We have to do something. As somebody who’s been a CPA — who’s practiced in front of the IRS for over 30 years, who understands how complicated the system is — we’ve got to make a difference. And the one big thing is that companies are going to continue to leave if we don’t do something. I’ve said that all along. But the number one reason people are leaving is because the rate’s too high. Our rate is too high and we can’t compete. In the business world, which I was in for 30 years, I used to always say, ‘You set your price.’ Once you do that, you can sell the vehicle, the motorcycle, or whatever it is you’re selling for that price and then adjust everything else underneath it.’ We’re really going to have to look at how we can get this rate down. I think the Chairman and the Committee are looking at that.”

“I agree with what Peter just said,” the Ohio Republican stated. “We have to change something. We have to do something. As somebody who’s been a CPA — who’s practiced in front of the IRS for over 30 years, who understands how complicated the system is — we’ve got to make a difference. And the one big thing is that companies are going to continue to leave if we don’t do something. I’ve said that all along. But the number one reason people are leaving is because the rate’s too high. Our rate is too high and we can’t compete. In the business world, which I was in for 30 years, I used to always say, ‘You set your price.’ Once you do that, you can sell the vehicle, the motorcycle, or whatever it is you’re selling for that price and then adjust everything else underneath it.’ We’re really going to have to look at how we can get this rate down. I think the Chairman and the Committee are looking at that.”

Renacci spent three decades as a successful entrepreneur before his election to Congress in 2010. Appointed to the Ways & Means Committee in 2013, he has tried to bring a business-oriented, bottom-line focus to his role on the tax-writing panel – one that is aimed not only at easing the tax burden on the American people, but at keeping companies from leaving the U.S.

“How can we make the United States more competitive so companies aren’t leaving?” he asked. “We’ve already started the process of rolling back regulations because that’s the other side of it. If we eliminate regulations and we reduce our rate, we can become very competitive. And we can keep companies from leaving. But it’s been 35 years, if you think about it, since we’ve looked at this code. And we have to make sure we do it right. It’s a difficult process, as we found out when we did the Camp draft. I always chuckle when I remember — we spend all this time, and then the first person in my office says, ‘You know what, I really like the Camp draft, but I don’t like this little section.’ Then the next person comes in and says, ‘I really like the Camp draft, but I don’t like this section.’ Well, by the time everybody had come through, they had totally ripped the Camp draft apart.

“And that’s a problem, because you’re not going to like what gets done. There’s no doubt about it. When it’s all said and done, people are not going to like it. But what I learned is that the more people that don’t like it, it’s probably the better job we’ve done. So we’re going to have to continue to work towards this. But it’s just like Peter said: this is the time. We have a President who wants to get it done. We have a House and a Senate that wants to get it done. We’re going to have to slug through this. We have to get something done in 2017. We can’t wait. Because after that, guess what starts to happen? The 2018 election, Senate elections, and the world starts changing all over again.”

Meehan echoed Renacci’s remarks about the importance of tax reform, and offered two additional reasons why he is hopeful that an agreement can be reached this year. The first reason is that Paul Ryan is serving as House Speaker and has years of experience in tax policy. The second reason, Meehan added, is that Donald Trump is now serving as President and has years of experience in business.

“We have a guy in the White House who understands how you build things using capital,” he said, referring to America’s new chief executive. “In the past, we had a President who knew how to create programs, and then run them by going back to business and saying, ‘You pay for it.’ And what a sea change it is if you add to it what Jim identified, which is the yoke of the regulatory oversight. If you can take those two things and unlock this tremendous potential, you’ve got to be excited about what we might be able to do.”

“We have a guy in the White House who understands how you build things using capital,” he said, referring to America’s new chief executive. “In the past, we had a President who knew how to create programs, and then run them by going back to business and saying, ‘You pay for it.’ And what a sea change it is if you add to it what Jim identified, which is the yoke of the regulatory oversight. If you can take those two things and unlock this tremendous potential, you’ve got to be excited about what we might be able to do.”

Following their remarks, the three members of the Tax Policy Subcommittee were asked what they were hearing about the issue of tax reform outside the Beltway and whether the people they represent were following the debate closely back home.

Meehan spoke first.

“Most people are not sitting around talking about tax reform right now,” the Pennsylvania lawmaker observed. “But there are two things that they are talking about. One is they really feel that they’ve been left behind. We’ve seen this remarkable growth in American opportunity, but it’s really taken place at the upper tier. There is a whole generation of voters who have not known this prosperity. They are who Donald Trump tapped into, by the way, and Bernie Sanders. What they’re looking for is jobs and opportunity. If you say to them, ‘We’re just going to double-down on what we’re doing here because it’s working so well,’ they get glassy-eyed and walk away. This is an opportunity to express a vision that appeals to a lot of them.”

Renacci agreed.

“Nobody is talking about the BAT,” he said, referring to the tax reform proposal that is being discussed in Washington these days. “They don’t know what a BAT is. The BAT’s going to hit them in the head eventually and we’re going to have to say, ‘Hey, this is what it is.’ But most people in the real world back home are talking about just what Pat said. They’re worried. I always tell this story. At 24 years-old, I started my own business. I was this glossy-eyed kid who said, ‘This world will give me these opportunities.’ I don’t think kids today see that anymore. They don’t see that opportunity. They don’t see that ‘I can dive in, start my own business.’ And they ask me, ‘Would I do it today?’ And I say, ‘Absolutely not.’ I wouldn’t do it today. I wouldn’t do what I did when I was 24. And that’s what we have to change — we have to change that perspective. We have a President who brought people over because he told them he’s going to let them have that opportunity again. And we have to make sure they realize we’re listening to them. If they don’t — if they feel we’re not listening to them — the Republican Party will pay a price.”

Roskam concurred, and concluded the discussion by recalling a conversation be had while back with one of the key figures in the 1986 tax reform debate.

“When I first got on the committee a few years ago and tax reform was in the air,” he recounted, “I reached out to James Baker — of James Baker fame. I asked him, ‘Give me your opinion. You were in the middle of tax reform in 1986. What’s your perspective?’ He was very generous with his time, but in the end he said something that I will repeat today. He said, ‘Peter, remember this. This was Ronald Reagan’s number one domestic priority of his second term. He used everything he had as Ronald Reagan. We used everything we had at the White House. We used everything we had at the Treasury Department. We had powerful bipartisan, bicameral sponsors on Capitol Hill. And it collapsed three times and it almost didn’t happen.’

“My point is, there is going to be an ebb and a flow to this. The emotions are going to be up and down. The White House is this, and the Senate is that, and the House is this thing and that thing. And you know, it’s all going to be very, very interesting. And at some point, we’re going to have to come together and make a decision.”

To view the remarks of Roskam, Renacci and Meehan before The Ripon Society’s breakfast discussion yesterday morning, please click on the link below:

The Ripon Society is a public policy organization that was founded in 1962 and takes its name from the town where the Republican Party was born in 1854 – Ripon, Wisconsin. One of the main goals of The Ripon Society is to promote the ideas and principles that have made America great and contributed to the GOP’s success. These ideas include keeping our nation secure, keeping taxes low and having a federal government that is smaller, smarter and more accountable to the people.