GOP Leaders of Financial Services Panel Lay Out Top Priorities for This Year

GOP Leaders of Financial Services Panel Lay Out Top Priorities for This Year

WASHINGTON, DC — The Ripon Society hosted a breakfast discussion Wednesday morning with the Ranking Member and subcommittee Ranking Members of the House Financial Services Committee, who discussed the legislative approach they are taking in the 116th Congress and some of the top legislative priorities they hope to accomplish moving forward this year.

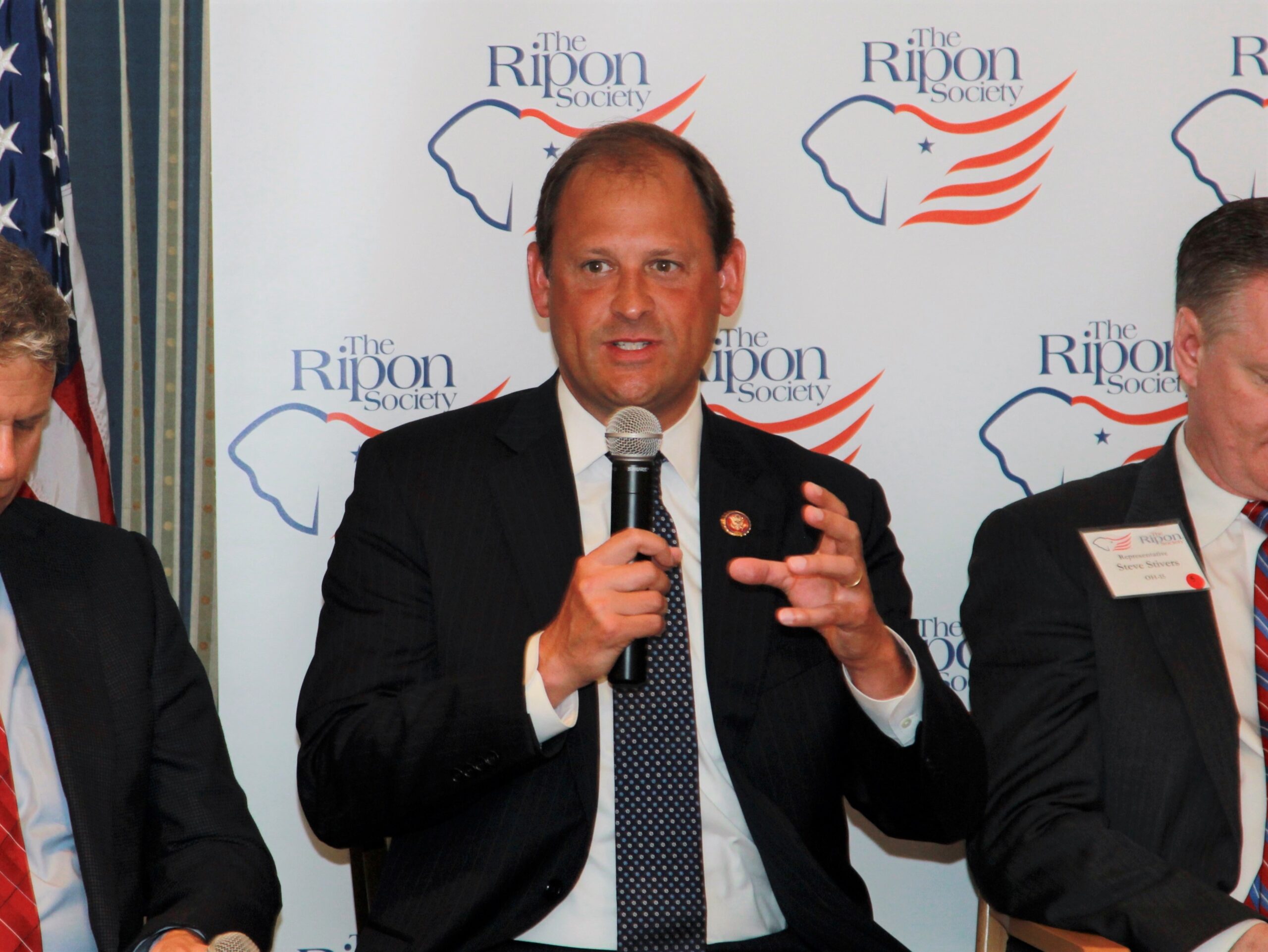

The U.S. Representatives appearing at the discussion included: Patrick McHenry (NC-10), the Ranking Member of the Financial Services Committee; Blaine Luetkemeyer (MO-3), the Ranking Member of the Subcommittee on Consumer Protection and Financial Institutions; Sean Duffy (WI-7), the Ranking Member of the Subcommittee on Housing, Community Development and Insurance; Steve Stivers (OH-15), the Ranking Member of the Subcommittee on National Security, International Development and Monetary Policy; Andy Barr (KY-6), the Ranking Member of the Subcommittee on Oversight and Investigations; and, Bill Huizenga (MI-2), the Ranking Member of the Subcommittee on Investor Protection, Entrepreneurship and Capital Markets.

McHenry moderated the discussion and opened his remarks by describing the approach he and the other Republican leaders are taking as the Democrat majority attempts to develop and work through a legislative agenda this year. “Overall,” he stated, “our approach is to deeply engage on policy that we think can make it into law and can have a positive impact on. That deep engagement may be mitigating really bad policy and making it less bad, or taking good policy and making it better.”

Luetkemeyer agreed, and added that part of the GOP approach this year also includes working with regulators to make sure federal rules and red tape are not getting in the way of working Americans who are trying to build a better life for themselves and their families.

“We fall back to them and say, ‘How can we help you do a good job of providing oversight over industry?’” the Missouri lawmaker said. “‘How can we keep your hands from being tied by the far left?’ I think we’ve got a good group of regulators in place now – not that they’re perfect, not that I agree with everything they do. But I think we need to allow the industry to function. I think we’ve got a good group that allows that to happen.”

Duffy concurred and pointed to a specific area where he hopes that Republicans and Democrats on the Committee can find common ground this year.

“I think we have a great shot at getting a bipartisan flood insurance bill done and getting the long term re-authorization,” he declared. “We’ve all been reasonable. Maxine’s team has been reasonable. We have larger points that we have to work through if that’s going to happen, but we’re making great progress. I don’t know if that’s before next week, but stay tuned for more progress on our bipartisan flood bill.”

Stivers said he hoped bipartisan agreement could be found on a plan to reauthorize the Export–Import Bank, as well.

“There is bipartisan cooperation going on between Chairwoman Waters and Patrick McHenry,” the Ohio Republican observed. “They’re negotiating, and I feel like something’s going to happen here. I think we’ll get that done. We’ll see what the contours look like when we get through it all, but I think it’ll be something that will help American jobs and help American exporters and help the American economy. And that’s what the EXIM Bank is supposed to do.”

Barr opened his remarks by commending the work that McHenry is doing as the Committee’s top Republican with Democrats in the majority this year.

“Patrick’s doing a great job,” he stated. “It’s not easy to be in the minority. This is our first opportunity to be in the minority since serving in Congress. We may be losing the votes, but we’re not losing the fight. And that’s the message I want to deliver today because we serve on the committee that is at the epicenter of capitalism in an environment where there is rising socialism.”

Huizenga echoed his colleague’s remarks on how Democrats view the role of government when it comes to financial services regulation.

“You know,” the Michigan lawmaker observed, “they tend to view five rules as being good, ten as being better, and twenty—that’s going to be awesome. So we’re trying to battle through that. But it is still about capital formation. It’s about making sure that we are creating an atmosphere for growth for investors and protections for those investors, and making sure that entrepreneurship can remain alive.”

The Ripon Society is a public policy organization that was founded in 1962 and takes its name from the town where the Republican Party was born in 1854 — Ripon, Wisconsin. One of the main goals of The Ripon Society is to promote the ideas and principles that have made America great and contributed to the GOP’s success. These ideas include keeping our nation secure, keeping taxes low and having a federal government that is smaller, smarter and more accountable to the people.