A Story Every Republican Should Tell

In 2016, the United States had a problem. During the postwar period until 2007, rapid economic growth had permitted the standard of living to double roughly every 35 years – about one working career.

After the economic crash in 2008, the economy was mired in a “new normal” of slow growth that promised to double the standard of living only every 70-75 years. Instead of achieving access to the American Dream in a single working career, workers watched as their hopes seemingly disappeared over the horizon. Indeed, in 2016 itself, it was even worse: the real (inflation-adjusted) growth in income for those households that worked full-time for the full year was exactly zero.

A new strategy was needed when Republicans took control of the administration and Congress. It began when the House passed the American Health Care Act – the health care bill that reformed two major entitlement programs and cut taxes by $1 trillion – continued with both legislative and administrative deregulation, included the Tax Cuts and Jobs Act (TCJA), and culminated with the administration’s international policy efforts – notably the U.S.-Mexico-Canada Agreement and the China Phase 1 trade deal. In short, the strategy moved from entitlement reform to regulatory reform, tax reform, and trade reform. What has been the effect of these policies?

Not all of these efforts yielded immediate fruit. Health care reform – which, since health care is approaching one-fifth of the economy, is economic policy reform – foundered in the Senate. And the jury is still out on the trade effort. The Administration’s fondness for tariff wars has always guaranteed short-term pain in the hopes of longer-term improvements. Time will tell.

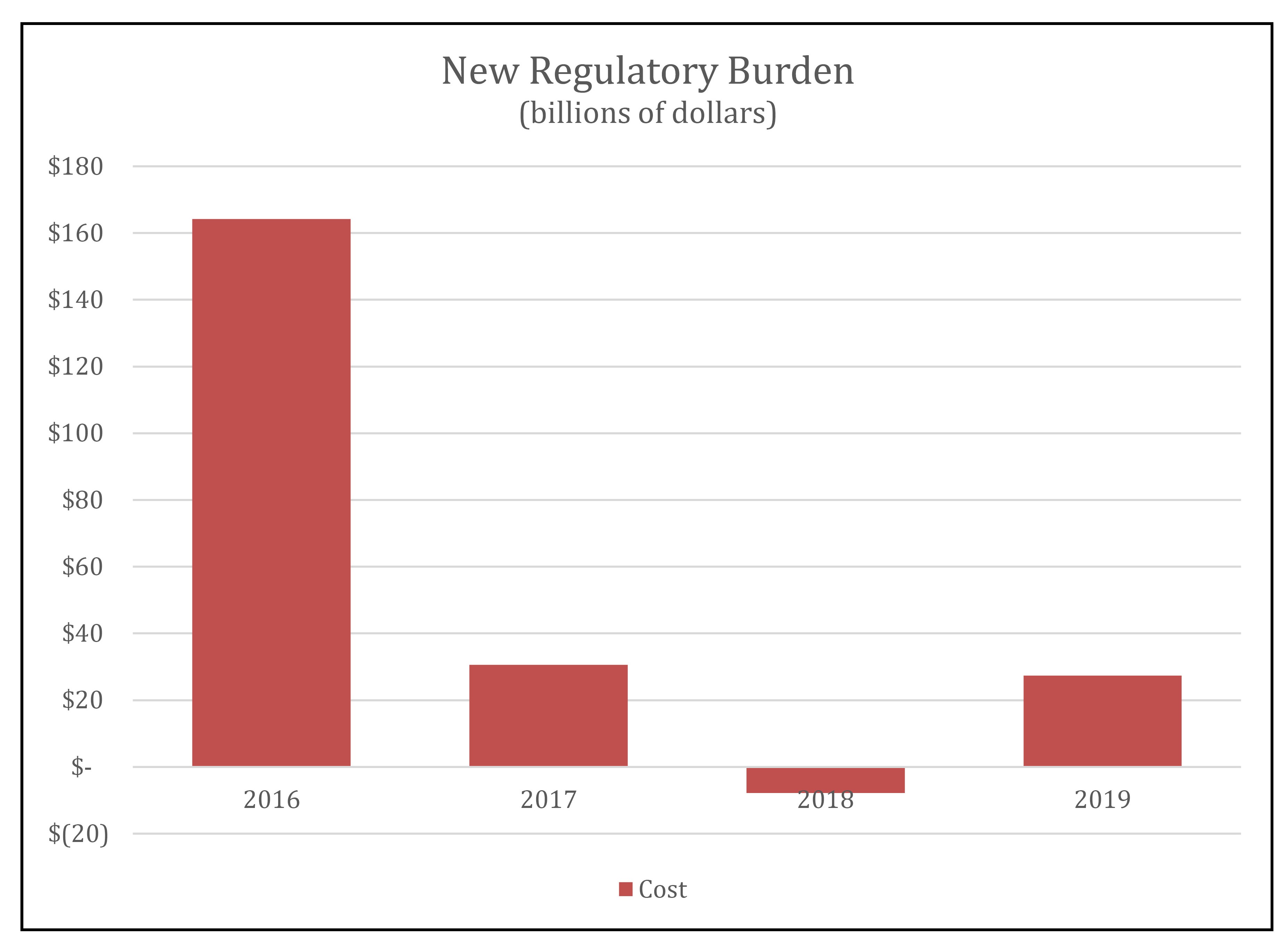

But the remainder merits a closer look. There was substantial early congressional action on Obama-era regulations using the Congressional Review Act. The main effort, however, has been the Administration’s imposition of regulatory budgets. As shown below, the difference between the implicit taxes levied in the Obama era (2016) and the Trump era (2017-2019) is like night and day. One has to believe that the business community – small and large – noticed and noticed quickly in 2017. It was an immediate and upfront push for the economy.

The next step was tax reform in December 2017 (although it is hard to date when the impact of an expected tax reform would start to occur). It is useful to remember the bipartisan acceptance of the need for tax reform, especially corporation income tax reform.

The U.S. corporate tax code had remained largely unchanged for decades, but other countries had not stood still. The result was highest statutory rate (35 percent) in the developed world, as well as an average effective tax rate of 27.7 percent compared to a rate of 19.5 percent for foreign-headquartered counterparts. In addition, the United States had clung to a worldwide system of taxation – at the highest rate. Thus, the only way for American firms to avoid being at a competitive disadvantage was to not repatriate their funds. This system distorted the international behavior of U.S. firms and essentially trapped foreign earnings that might otherwise be repatriated back to the United States.

The difference between the implicit taxes levied in the Obama era (2016) and the Trump era (2017-2019) is like night and day … It was an immediate and upfront push for the economy.

In contrast, other countries had busily been shifting toward territorial systems that to a great degree exempted overseas earnings. Of the 34 economies in the Organization for Economic Co-operation and Development, for example, 28 have adopted such systems, including recent adoption by Japan, the United Kingdom, and New Zealand. The result? It made no sense from a tax perspective to have a U.S.-headquartered corporation, and the issue of so-called “inversions” remained at the forefront of tax policy and politics.

The TCJA has successfully addressed these problems. In the immediate aftermath of its passage, enormous sums of overseas earnings were finally repatriated to the United States – and the amounts remain elevated by historical standards (see below).

The success regarding inversions is even more striking. After years of having five to six prominent companies annually depart the United States, inversions have simply stopped.

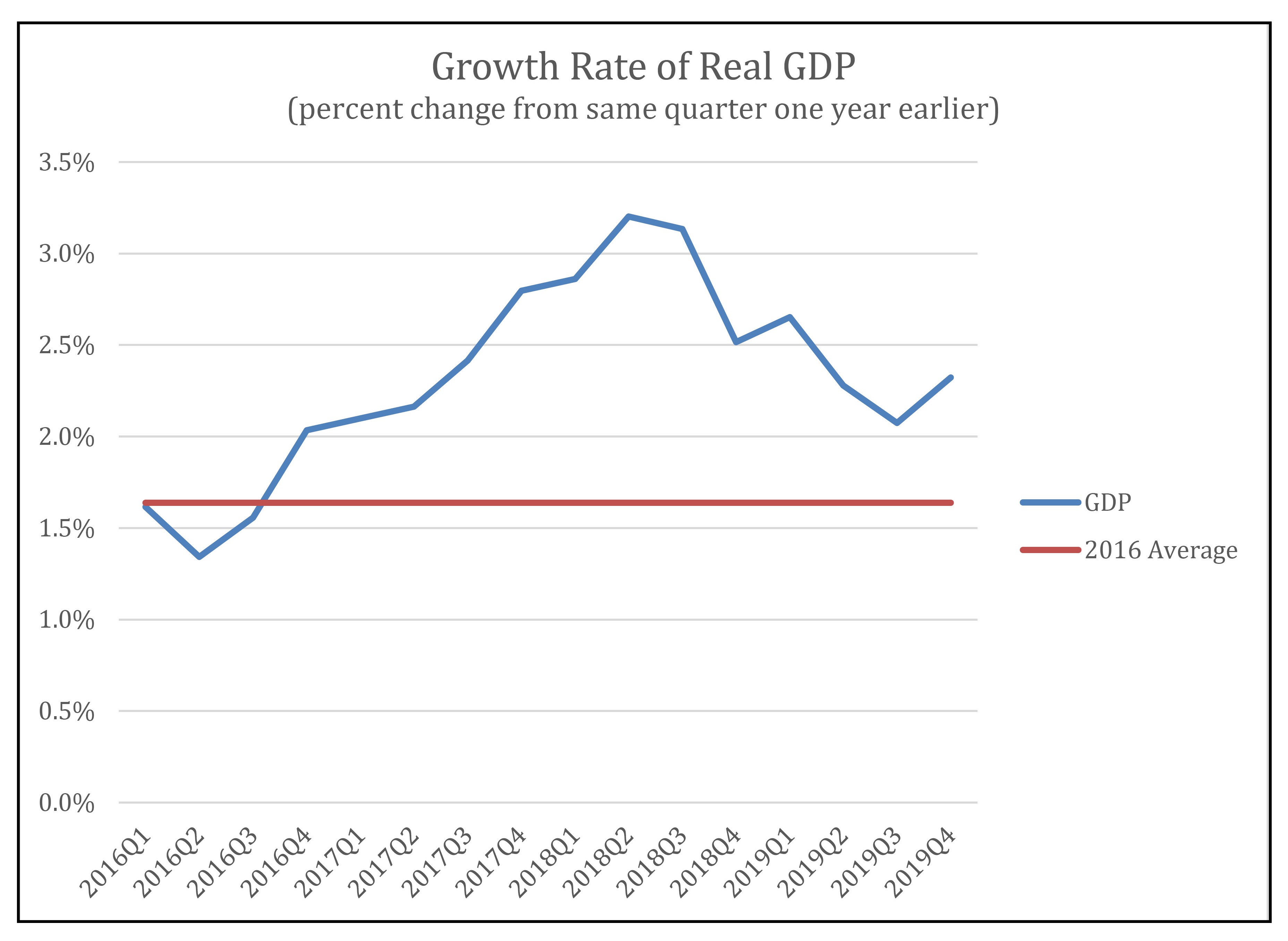

Of course, the bottom line is whether the plan has produced better growth. Certainly, the top-line economic growth has improved.

While remaining above the 2016 level, the growth rate tailed off in 2019. This drop coincides with slower business investment (below) and, especially, the arrival of a full-blown trade war.

Looking forward, there will be a clear incentive by the 2020 Democratic presidential candidates to paint the Administration, and especially the TCJA, as a failure. But the numbers simply don’t support that narrative. Unemployment is low, and hundreds of thousands of discouraged workers have been drawn back into the labor market. Real wages are rising, especially for lower-skilled workers. And growth has returned.

The economy has benefitted enormously from regulatory reform and tax reform. It would have benefitted even more from entitlement reforms. And one can only hope that it will reap the benefits of the trade reforms going forward.

Douglas Holtz-Eakin is the President of the American Action Forum.